After a tumultuous 2019, healthcare organizations are pivoting to make sense of the latest changes and prepare to face the top 2020 healthcare trends:

• Consumerism—Can health systems respond to the consumer demands of better access and price transparency?

• Financial Performance—With mergers, acquisitions, and private sector companies entering the healthcare arena, how will traditional hospitals and clinics compete?

• Social Issues—How will health organizations respond to the opioid crisis and consider social determinants of health as part of the care process to provide comprehensive treatment?

As health systems struggle to survive amidst constant change, they must look forward and proactively prepare for what’s to come in 2020.

This report is based on a 2019 webinar given by Stephen Grossbart, PhD, Senior Vice President and Chief Quality Officer, Health Catalyst, titled, “The Biggest Healthcare Trends of 2019 and What’s to Come in 2020.”

After a year full of change and many topics competing for the headlines in 2019, politics and reform, the Affordable Care Act (ACA), prescription drug access and pricing, and price transparency were major areas of focus politically. As healthcare and politics are deeply intertwined, we know that any changes in our political landscape have a direct impact on healthcare.

As healthcare organizations scramble to respond to changes from 2019, they need to look forward and prepare for changes in 2020 that could imminently impact procedure pricing protocol, reimbursement rates, and patient satisfaction. Health systems have more opportunity than ever before to leverage data and technology to deliver the best care to all patients, no matter where they live.

The ACA was enacted in March 2010 and was still one of the top 2019 healthcare trends. Although some courts have fought the legislation, it has yet to be repealed entirely. For example, in December 2018, the Texas District Court ruled that the ACA was unconstitutional. In May 2019, the Trump administration and justice department, which is historically responsible for defending a federal act or statute in the courts, chose to support the repeal of the ACA. The case reached the Fifth Circuit Court of Appeals, which heard oral arguments in July 2019.

Of course, no change will be enacted until 2020 when the Supreme Court hears the case. However, if the Supreme Court votes to repeal the ACA, the effects will be far-reaching for patients and health systems, as 21 million Americans will lose insurance coverage.

With an unsuccessful attempt to repeal the ACA, a gridlock in Congress, and the absence of constructive legislative action, the Trump administration still made big waves that deeply impacted health organizations, payers, and patients through executive orders:

Medicaid expansion was a hot topic for debate in 2019 and will continue to be well into 2020. Although Medicaid expansion legislation was passed in 2018 and took effect in 2019, referendums and legislation are still pending in many places throughout the United States:

The Medicaid expansion legislation intensely affects healthcare organizations and patients because Medicaid expansion means more people have access to healthcare than before. Health systems need to be prepared to care for this new influx of patients without compromising quality and also ensuring they meet CMS standards of care in order to receive reimbursements.

Medicaid expansion allowed people in remote communities, such as throughout the Mountain West, to access care that was previously unavailable. As a result, critical care hospitals and smaller healthcare organizations started merging and contracting specialty services with other organizations. For example, small hospitals throughout southern Utah, southeast Idaho, and southern Wyoming with University of Utah Health and Intermountain Healthcare to provide specialty care to patients within their communities.

As prescription drug prices skyrocket, and pharmaceutical companies and politicians continue to debate who should pay, a new bipartisan bill appears to offer at least some of the answers.

The White House endorsed the Senate’s bipartisan Prescription Drug Pricing Reduction Act, sponsored by Chuck Grassley (R-Iowa) and Ron Wyden (D-Ore), in November 2019. Unlike the House’s titled the Elijah E. Cummings Lower Drug Costs Now Act, the Senate Bill does not give the Department of Health and Human Services (HHS), the government body with jurisdiction over public health, the ability to negotiate drug prices or target private insurance.

Although the Prescription Drug Pricing Reduction Act bill establishes a $3,100 cap on annual out-of-pocket spending in Medicare Part D, starting in 2022, its main objective is to create incentives for payers to manage costs throughout all phases of the Medicare Part D benefit journey. If Congress passes this bill, Medicare Part D beneficiaries’ out-of-pocket costs will be dramatically reduced and, ideally, the payers will negotiate lower drug prices with pharmaceutical companies that would lead to lower, more affordable drug prices and effective drug pricing negotiations and management.

Price transparency is a trending concept in today’s healthcare landscape. President Trump’s executive order in June 2019 called for increased called for increased pricing transparency in healthcare so that consumers could understand the full cost of a procedure or service and have the ability to shop around and make the most informed decision.

The executive order calls for HHS to publish prices that “reflect what people actually pay” and requires healthcare providers and payers to disclose out-of-pocket costs. With increased information available to consumers, payers and providers are incentivized to improve quality and cost, driving down healthcare prices without compromising the level of care.

As we reflect on the many revolutions that changed the healthcare climate, it’s time to look forward. With pending legislation, health systems must prepare for the changes to come in 2020.

As price transparency increases and consumers—and CMS—demand quality care for less, healthcare organizations need new ways to succeed within the VBC landscape. Alternative payment methods—including ACOs, shared savings, shared risk and bundled payments, and population-based at-risk contracts—are just some examples of new payment models that link cost and reimbursements to quality as the fee-for-service model continues to diminish.

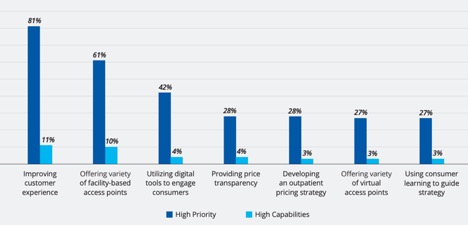

Another aspect of the new consumerism approach to healthcare is mergers and acquisitions. As companies from both the private and public sector join forces to solve health care’s biggest problems, health systems should ask themselves if they are ready to compete in this new landscape. Data shows that healthcare providers are not currently meeting their consumers’ highest priorities (Figure 1).

Another part of a consumer-driven healthcare landscape is access through virtual healthcare, or telehealth. Healthcare organizations should offer, or consider offering, easily-accessible healthcare consultations—like virtual healthcare and telehealth—that also emphasize quality care with convenience and easy scheduling.

As the push for virtual healthcare continues, so does the pressure for health systems to develop these programs, which requires a major overhaul for some organizations. Health systems need have the following capabilities:

Although implementing virtual healthcare and telemedicine programs is challenging, many health systems are proving they’re up to the task:

While there have been many notable mergers in the past few years—for example, the merger of HCA Healthcare and Mission Health, and Mercy Medical Center joining Cleveland Clinic, to name a few—it is unclear how these newly created companies will impact the future of health systems and insurance companies.

Private sector companies are also playing a part in healthcare on an unprecedented level. Companies like Amazon and Sam’s Club are taking aggressive tactics to solve these complex healthcare challenges rather than relying on traditional methods. For example, both companies now offer virtual clinical and home visits for their employees. Google is hiring physicians from and to develop new healthcare solutions that could possibly threaten current healthcare organizations by taking patients away from traditional hospitals and clinics.

In addition to mergers and private sector activity, dramatic changes in healthcare costs occurred in 2019—an increase in family coverage plans, increases in overall insurance costs, worker/employer share, etc.—and those changes are likely to continue well into 2020 (Figure 2).

Employers also had to deal with the new 1.9 million new beneficiaries added to Medicare Advantage in 2019, representing 34 percent of the total Medicare population. These add more cost burdens for employers and healthcare organizations as they strive to provide care for this increasing population with limited financial resources.

As the business of providing healthcare becomes more complex, so does the process of treating individual patients. Instead of looking through a myopic lens that only allows a provider to see a patient with an illness, clinicians and their multidisciplinary teams are now collecting socioeconomic information as part of the care process. Where a patient resides, employment, family situation, etc. all affect an individual’s health and clinicians should include this information throughout the care process.

Social Determinants of Health

Social determinants of health (SDoH) impact mortality, morbidity, life expectancy, healthcare expenditures, and health status and functional wellbeing, to name a few. They also cause major disparities in health and healthcare.

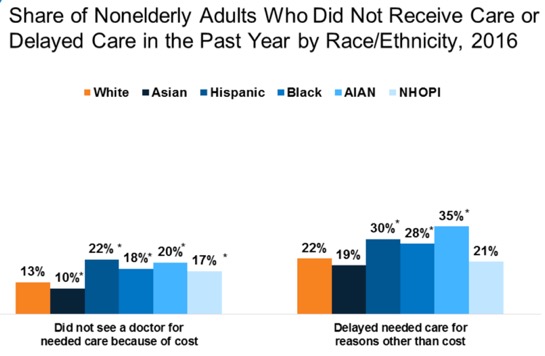

The data clinics, health plans, and hospitals are collecting today is far richer than it used to be and can highlight inequality. Data shows, for example, a stark disparity when it comes to healthcare cost being a deterrent to getting care. Anywhere from 10 percent to 22 percent, depending on race and ethnicity, did not see a doctor because of the cost, and anywhere between 19 percent and 35 percent delayed needed medical care because of the cost (Figure 3).

These disparities lead to situations where patients is prevented from following medical advice due to cost. For example, a diabetic patient will stop taking insulin or use less insulin than they need to survive because of the high cost of this prescription drug.

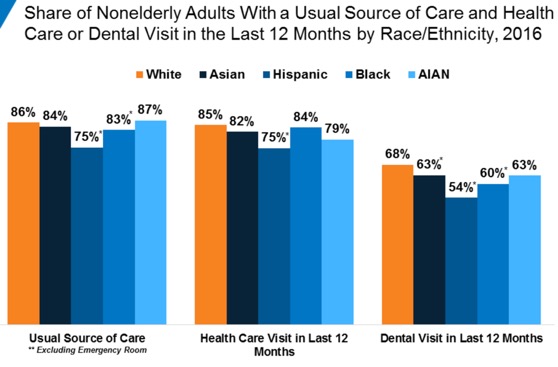

The percentage of patients with a usual source of care ranges from 75 to 87, depending on ethnicity. Those who have seen a doctor in the past 12 months or had a healthcare visit in past 12 months ranges from 75 percent to 85 percent, again, depending on ethnicity. Lastly, this disparity also appears among those who have seen a dentist in the last 12 months; between 54 percent and 68 percent (Figure 4).

With source of care and health visit data clearly illustrating the need for better access, health systems have the insight to improve care across underserved race and ethnicity categories.

The Opioid Crisis

As the fight to combat , so does the legislation to overcome it—the Substance Use Disorder (SUD) Prevention that Promotes Opioid Recovery and Treatment for Patients and Communities Act was passed in 2018. The benefits of this legislation will continue throughout 2020:

Another promising development to help combat the opioid epidemic is the additional number of codes for on opioid use disorder and the telemedicine parity law, passed in 36 states and District of Columbia. Telehealth allows people who live in hard-to-reach places to access the same opioid addiction recovery services that are offered in an urban area. The new telemedicine parity law requires private insurance companies to cover telehealth the same way they cover in-person visits, making opioid disorder support services more affordable.

2019 was a tumultuous year for healthcare. Health systems should adjust to the changes and also prepare for 2020 by considering key questions:

The time to prepare for change in healthcare legislation, healthcare access and delivery, and payment methods is now—health systems need a clear goal and a strategic plan, based on their current knowledge, that will help them get there.

As health organizations continue to evolve in an everchanging landscape, digital health, alternative payment models, and better data, including social determinants of health, are key pieces to the puzzle. Health systems have opportunities to improve like never before; new types of organizations are entering the healthcare industry with new ideas, technology is changing the method of delivery, and patients are demanding price transparency.

The only way for health systems to remain successful, and flexible, is to be willing to try new ways of healthcare delivery and to never lose sight of the reason the organization exists—to provide the care to each patient, when, where, and how they need it.

Would you like to learn more about this topic? Here are some articles we suggest:

Would you like to use or share these concepts? Download the presentation highlighting the key main points.