The Key to Transitioning from Fee-for-Service to Value-Based Reimbursement

The switch to value-based reimbursement and value-based care models turn the traditional model of healthcare reimbursement on its head, causing providers to change the way they bill for care. Instead of being paid by the number of visits and tests they order (fee-for-service), providers’ payments are now based on the value of care they deliver. And while the industry waits for the final policy from the federal government, one thing is certain—the trend for value-based approaches will continue.

Much of this change is long overdue and quite exciting because it’s driving improvements to the delivery of care by mandating better care at a lower cost. But for providers and health systems that can’t achieve the required scores, the financial penalties and lower reimbursements create a significant financial burden.

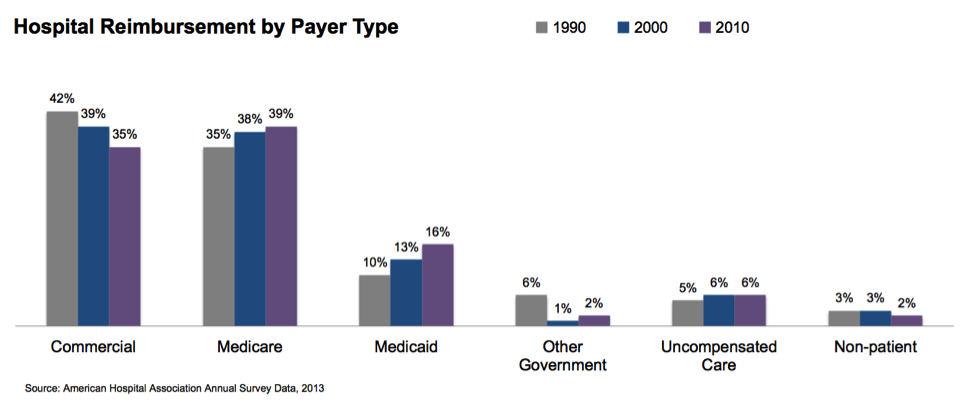

Shifting Revenue Mix: The Rise of Medicare and Medicaid and Value-based Care

The first hospital challenge, shifting revenue mix, is demonstrated in the graph below. The percentage of commercial payers will continue to shrink, while payer types with lower reimbursement rates will increase.

Medicare expenditures continue to grow as the baby boomer population ages. But over the same time period, Medicaid has grown at an even faster rate. This trend will most likely continue as baby boomers continue to age and the Medicaid expansion authorized in the Affordable Care Act is fully implemented.

This change in revenue mix impacts a hospital’s bottom line because Medicare and Medicaid patients generally aren’t profitable. In 2011, the average hospital margin on Medicare patients was -5 percent. A growing proportion of Medicare business puts considerable strain on hospital revenues.

Transitioning to Value-based Payments: Three Key Challenges

The transition from a fee-for-service (FFS) reimbursement system to one based on value is one of the greatest financial challenges for health systems. Although there are too many transition-related challenges to sufficiently cover in one article, here are the top three:

Challenge #1: Reconciling Value-Based Payments in a Fee-for-Service Environment

Value-based payment contracts are in their infancy and most are structured according to a shared savings model. Shared savings arrangements vary, but they typically incentivize providers to reduce spending for a defined patient population by offering them a percentage of any net savings they realize. The Medicare Shared Savings Program is the most well-known and standardized example of this new model.

Tracking performance in this kind of arrangement is a significant challenge for health systems because it requires keeping track of two very different payment systems simultaneously. Medicare continues to reimburse health systems on an FFS basis; then, at the end of the year, shared savings bonuses are calculated. Medicare benchmarks each provider against the rate of increase for the overall FFS population. If a hospital did better than the FFS population, they get a piece of the savings. Hospitals must operate in the FFS world while attempting to anticipate this value-based bonus.

Tracking shared savings reimbursements that come in at the end of the year requires health systems to be much more sophisticated in their accounting capabilities than most are today. It simply won’t work to account for all payers and all patients in the same way. A hospital has to know every patient in the accountable care organization (ACO), what services they’re getting, and what it costs. An ACO environment requires asking important questions, such as, “For each defined population of patients, what was our financial performance and how did it compare to the contract?” The ability to measure performance at this level of granularity will require much more sophisticated IT capabilities than most health systems have.

Challenge #2: Tracking a Wide Variety of Quality Measures

Many of today’s value-based incentives—and penalties—rely on quality measures. For many years, providers have submitted quality measures for programs such as Hospital Inpatient Quality Reporting (IQR), Hospital Outpatient Quality Reporting (OQR), and Physician Quality Reporting System (PQRS). The fact that these measures are now tied to penalties and incentives is new. These new value-based models require providers to prove that they’re meeting quality standards and benefitting patients while cutting costs.

Providers need sophisticated analytics to help them measure financial and quality performance for each patient population. They don’t want to learn that their reimbursement is going to be poor when it’s too late to do anything about it. Providers want to know in the first quarter, so they can improve their performance before the end of the year.

To do this, they need to be able to measure performance on a continuous basis. Furthermore, if they aren’t meeting quality standards, they need to be able to pinpoint the cause: Does performance differ by facility? Which providers are performing best and what can be learned from them?

It’s one thing to handle this level of performance analysis for a single patient population or a single quality measure; it’s another story altogether when you consider how quickly the number of measures a health system must track multiplies. For example: tracking 30-day readmissions—a small but important area of performance measurement. For the last few years, Medicare has required hospitals to track their 30-day readmissions rates for heart attack, heart failure, and pneumonia patients. Medicare is adding three additional populations to this requirement. Many private payers require that health systems track this measure for populations covered in their contracts. Health systems must also track 90-day readmission rates. This 30-day readmissions example is further complicated by the myriad of potential quality measures and patient populations, demonstrating how complex this process can become.

Challenge #3: Optimizing Margins as Revenue Drops

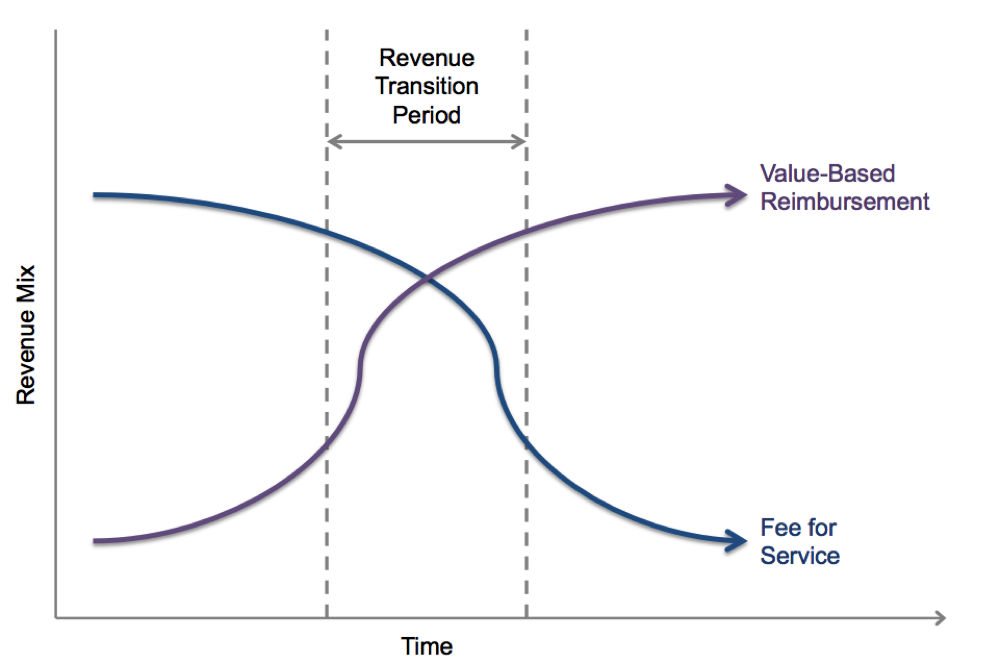

The transition from FFS to value-based reimbursement will take years—and it will hurt in the short run. Meeting value-based goals requires hospitals to reduce utilization among their populations, therefore reducing their procedure volume and revenue. The following simple graph illustrates this trend:

No specific units of time have been included in this graph because we don’t know how long this process will take. But we do know there will be a transition period, during which time to total revenue will likely decrease because the pressure on a hospital’s FFS revenue will increase faster than it can grow its revenue through value-based reimbursement. And that can be scary.

The Key to Transitioning from Fee-for-service to Value-based Reimbursements

The ultimate key to success in this transition—and beyond—is to constantly wring out costs. With decreasing revenue, hospitals have to improve margins as much as possible. To do so, hospitals need to focus on three key things:

#1: Effectively Manage Shared Savings Programs to Maximize Reimbursement

Hospitals must manage shared savings contracts with expertise to qualify for every possible bonus. Effective management of these contracts not only gets shared savings payments, but also improves quality and lowers costs.

#2: Improve Operating Costs to Deliver Care More Efficiently

In a value-based environment, any investment in streamlining operations and eliminating waste from the system goes directly back to the hospital, not the payer. Hospitals must develop the sophistication to understand their cost structure in granular detail. Reducing every category of waste—waste that stems from work that isn’t standardized, unnecessary orders, and patient injury—is absolutely essential for improving margins.

#3: Increase Patient Volume

As hospitals eliminate waste, improve quality, and reduce costs, they will increase patient volume. Payers will see that a given hospital is a top performer and include it in their networks. Payers and even large employers, such as Wal-Mart, are becoming laser-focused on this issue; they want their employees and members to go to the highest-performing facilities for care and incentivize them to do so. Increasing patient volume is key to counteracting the loss of procedure volume that comes with a value-based system.

An Analytics Infrastructure to Meet These Challenges

The transition-related challenges health systems face may seem insurmountable. Implementing a healthcare Data Operating System (DOS™) creates an analytics foundation that makes meeting these challenges possible. DOS can’t stop the influx of baby boomers into the Medicare ranks, but it can give the tools and insight needed succeed in the transition to value-based reimbursement:

- Understand the complete cost structure picture.

- Succeed in shared savings arrangements.

- Automatically track quality measures.

- Improve performance.

- Streamline operations.

- Reduce waste.

- Improve margins.

PowerPoint Slides

Would you like to use or share these concepts? Download this heart failure readmission presentation highlighting the key main points

This website stores data such as cookies to enable essential site functionality, as well as marketing, personalization, and analytics. By remaining on this website you indicate your consent. For more information please visit our Privacy Policy.