$2.2 million saved

in 16 months while maintaining high-quality outcomes

Uncover investment opportunities, enhance contract negotiations, and reduce inefficiencies with trusted data and insights using the Health Catalyst Business Decision Support™.

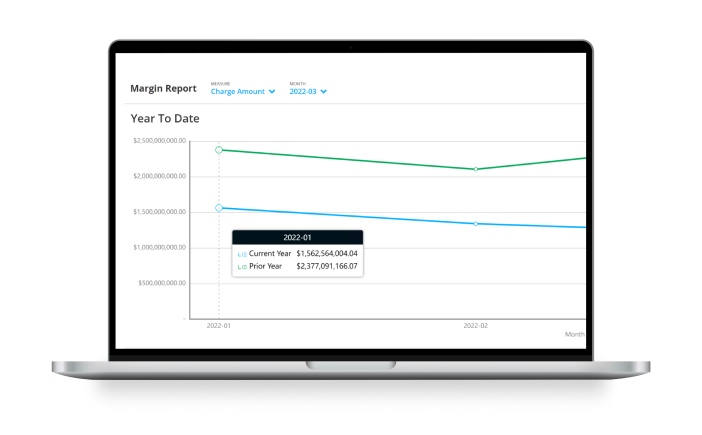

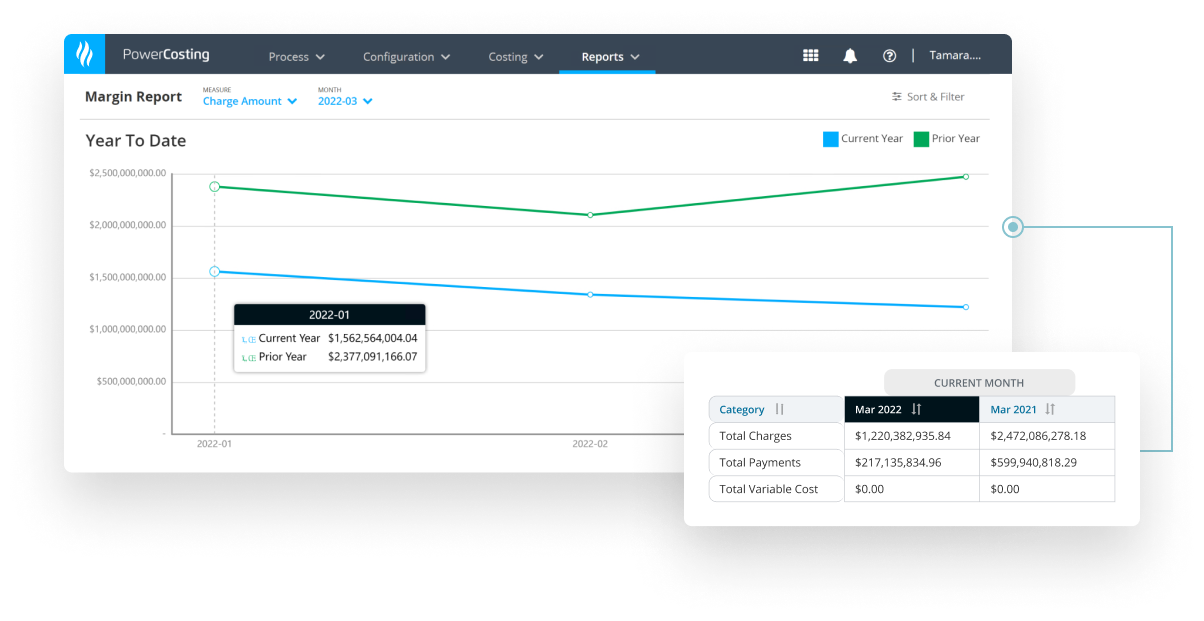

Our activity-based costing system helps health systems understand the true cost to lower expenses, reduce variation, and negotiate favorable at-risk contracts.

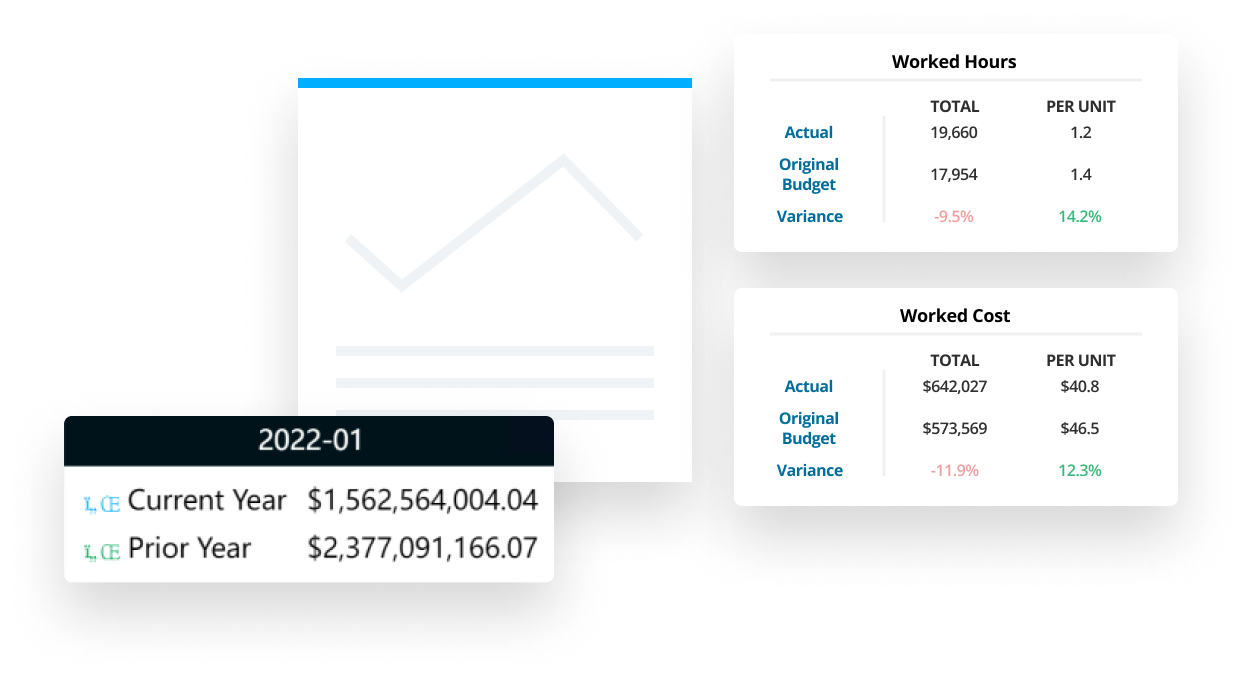

Our labor productivity solution helps operational users get more accurate, timely, and actionable data, plus AI forecasting capabilities, to manage labor expenses.

Tailor your financial analytics with clinical analytics context to better manage your health system’s unique needs.

This website stores data such as cookies to enable essential site functionality, as well as marketing, personalization, and analytics. By remaining on this website you indicate your consent. For more information please visit our Privacy Policy.