Was COVID-19 a wake-up call to prioritize healthcare analytics and merge them with other healthcare goals? Healthcare data and analytics have become inextricable from the pandemic response, proving to the industry it can’t save lives at scale without this information and insight. In a 2021 survey of healthcare leaders and professionals, nearly 80 percent of respondents report they plan to maintain pandemic-driven data and analytics shifts for the long term. And with most respondents recognizing gaps in their data and analytics and noting COVID-19-driven changes in the data and analytics landscape, the pandemic may likely catalyze a new, more robust era in healthcare technology and decision support.

Healthcare data and analytics has become inextricable from the COVID-19 response. From emergency department frontlines and hospital capacity planning to vaccine development and future emergency response, the industry has relied on COVID-19 data and analytics to understand the disease, keep populations safe, and eventually reopen communities.

Yet, according to a late 2020/early 2021 Health Catalyst survey of predominantly health system team members, most respondents weren’t ready for the pandemic on the data and analytics front. Most report gaps in the data needed for COVID-19 response, and even more say they’ve had to change operations and processes to capture missing data.

The above lack of COVID-19 data and analytics preparedness contrasts starkly against the industry forecast that the global healthcare analytics market will be worth $70 billion by 2027. While healthcare escalated its data and analytics use during the acute phases of the pandemic, questions arise around these digital resources’ role in the post-pandemic era. How has COVID-19 impacted organizational data and analytics? And are these developments short-term adaptations, or will they continue to shape care delivery and operations?

With survey questions covering COVID-19’s impact on analytics, the majority of respondents report some increase in their analytics demand, including bridging gaps in data and changing capabilities needs. Having any analytics in place has allowed organizations to pivot and build what they need under pressure. These insights stand to shape the immediate future of healthcare data and analytics as pandemic-era patterns and practices carry over into a new industry landscape.

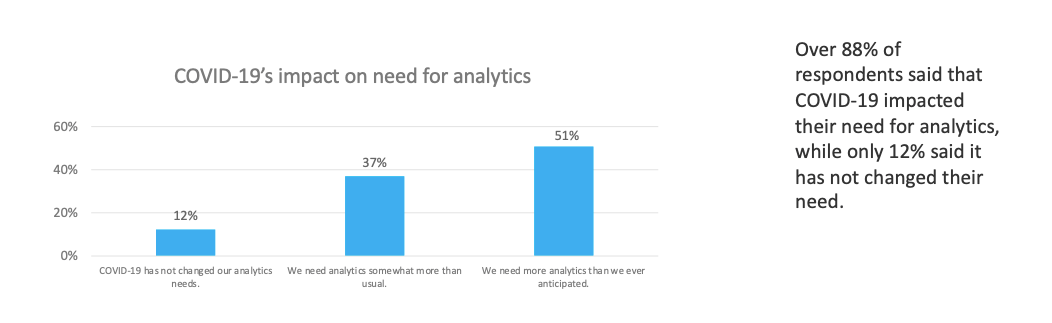

Survey feedback leaves little room for doubt whether the pandemic made an impression on healthcare analytics. Over 88 percent of respondents say COVID-19 has impacted their need for analytics, leaving only 12 percent reporting no change in analytics need.

Leadership and financial roles appear the most interested in pandemic-response data and analytics. Nearly 50 percent of respondents serve as a VP, SVP, or C-Suite. Although respondents operate in a variety of departments within their organizations, one-third work in finance. A vast majority, 92 percent, work in a healthcare system, while the remaining 8 percent work for a Federally Qualified Health Center (FQHC) or physician group or clinic. COVID-19 data and analytics concerns also appear to span revenue, as respondents represent a broad spectrum of profit levels.

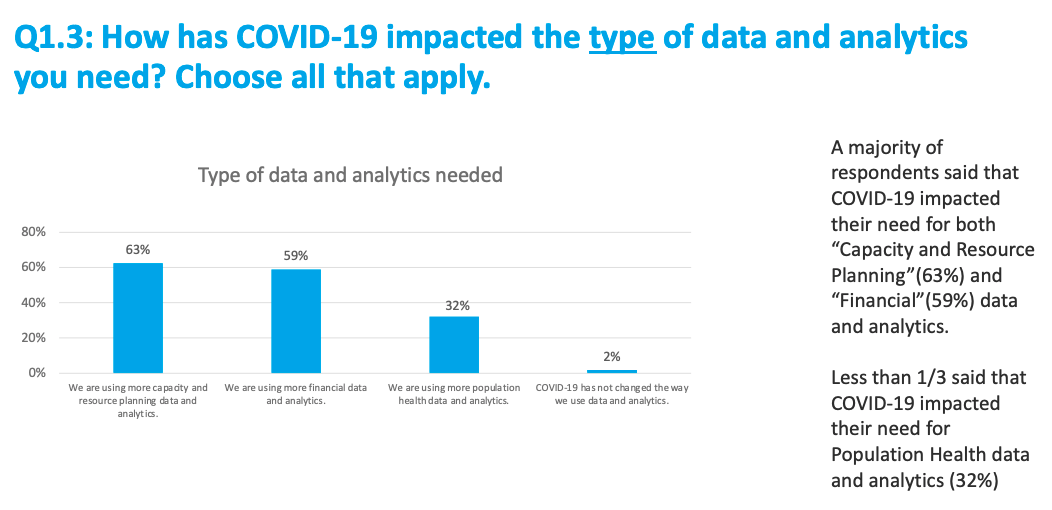

At 63 percent, the majority of respondents say capacity and resource planning has been their biggest driver of pandemic-response analytics, with financial needs a close second at 59 percent. Less than one-third, 32 percent, of participants say COVID-19 impacted their need for population health data and analytics (Figure 1).

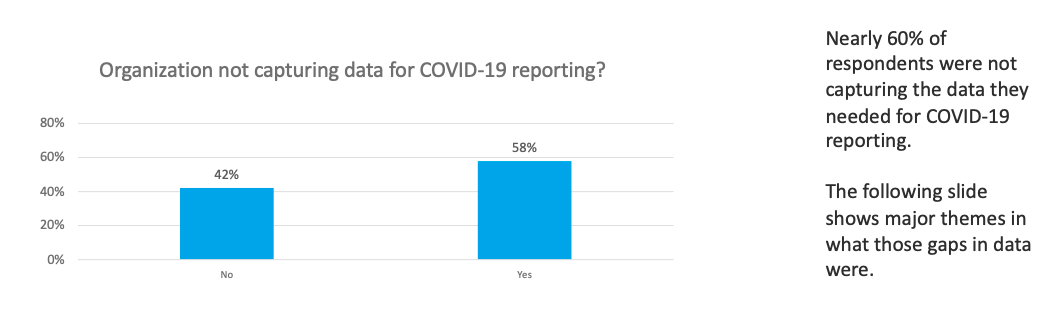

More than half of respondents (nearly 60 percent) respondents say they haven’t captured the data they need for COVID-19 reporting (Figure 2).

The most reported data and analytics gaps are the following:

Of respondents who say they were not capturing the data they needed for COVID-19 reporting, an overwhelming 88 percent say they’ve had to change their operational processes to collect that data (Figure 3).

Respondents’ most significant operational changes include the following:

Ninety percent of respondents say COVID-19 has impacted their population health strategy. Among them, just over half are devoting additional resources to incorporate population health strategy into their decision making. Telehealth and virtual health have overwhelmingly made the most significant impact on pandemic-driven changes to population health strategy. And nearly 80 of respondents plan to continue these population health shifts after the pandemic.

An overwhelming majority (78 percent) say their organization’s top priorities around COVID-19 are financial. A majority of respondents also name operational changes and frontline care as urgent areas.

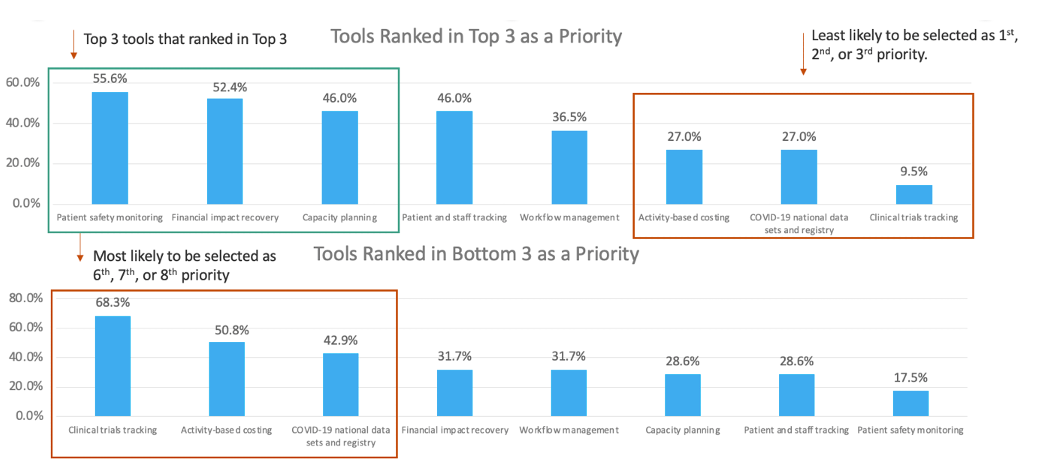

Patient safety monitoring tools have been the top priority for COVID-19 response, with almost 56 percent of respondents ranking them as number one. Financial impact recovery tools follow closely at 52 percent, with capacity planning coming in third at 46 percent (Figure 4).

Respondents name health and safety as their top categories for personal and professional pandemic concerns, with financial and staffing matters following. Specific examples from each category include the following:

Was COVID-19 a wake-up call to prioritize healthcare analytics and merge them with other healthcare goals, now that the industry knows it can’t save lives at scale without data and analytics? The need for pandemic-related data and analytics is here for the foreseeable future, with 78 percent of respondents citing financial data as top need and nearly 80 of respondents planning to maintain pandemic-driven population health shifts for the long term.

Only time will tell whether health systems will get their data and analytics houses in order now—before they need them again—or wait for another significant disruption to surface these weaknesses. But with most survey respondents recognizing gaps in their data and analytics and noting COVID-19-driven changes in the data and analytics landscape, the pandemic may likely catalyze a new, more robust era in healthcare technology and decision support.

Would you like to learn more about this topic? Here are some articles we suggest:

Would you like to use or share these concepts? Download this presentation highlighting the key main points.