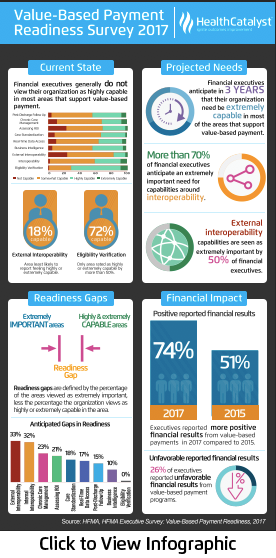

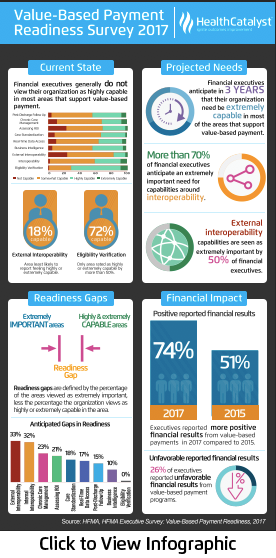

How prepared are healthcare organizations to enter into value-based care? Many may not be ready. While early value-based care adopters have focused on improving and measuring quality, they’ve often overlooked steps to bear the associated financial risk. Now that health systems can enter into alternative payment models and risk-based contracts, they need to ensure that cost is as much a priority as quality.

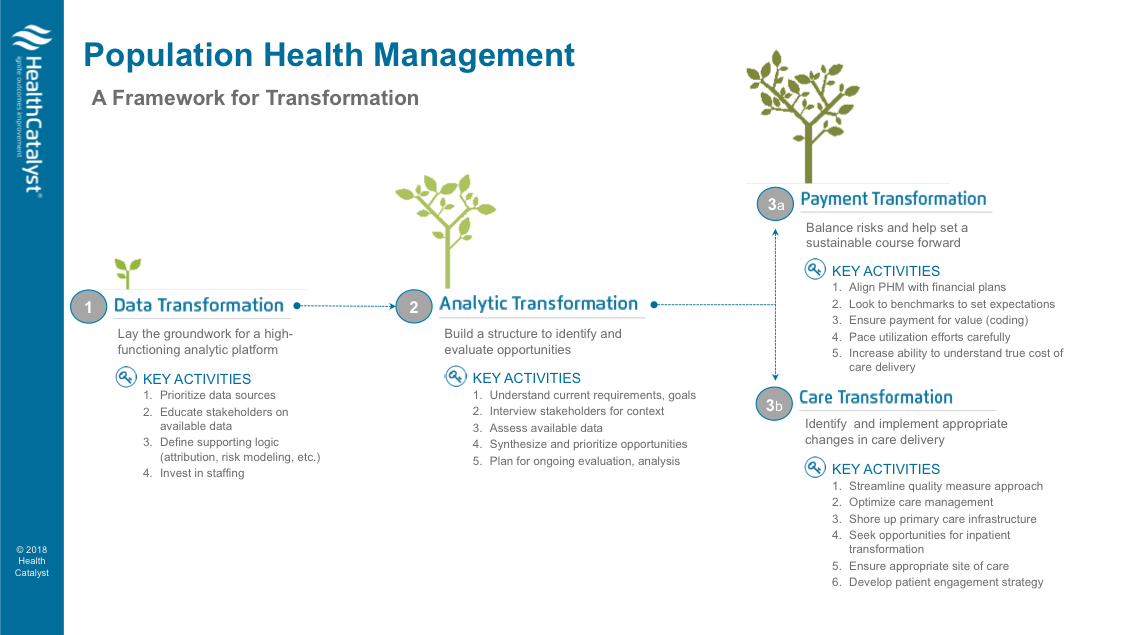

Health systems can achieve sustainable value-based care success by optimizing the five core competencies of population health management:

1. Governance that educates, engages, and energizes.

2. Data transformation that addresses clinical, financial, and operational questions.

3. Analytic transformation that aligns information and identifies populations.

4. Payment transformation that drives long-term sustainability.

5. Care transformation as a key intervention in value-based contracts.

After an era of discussion, demonstration projects, and education, many healthcare organizations are transitioning into a variety of value-based care contracts. Now health systems have opportunities to enter into government payer alternative payment models (APMs) that appropriately meet each system’s readiness to take on the financial risk for specific patient populations.

With such APM opportunities (and depending on how the local market adopts value-based contracting principles), organizations can no longer afford to sit on the sidelines of payment transformation. According to a 2017 Health Catalyst survey of 199 healthcare leaders, 80 percent of organizations believe at least 30 percent of their contracts will incorporate at-risk payments over the next five years.

This white paper reviews the evolution of value-based contracting, including the difficult lessons early clinically integrated systems learned, the new dynamics that drive value-based care success, and the key interventions that impact contracts. The paper also explains how, by leveraging a framework based on a thorough understanding of five population health management (PHM) competencies, health systems can drive effective clinical and financial outcomes across the value-based care continuum.

Any discussion of value-based care must start with an understanding of the evolution of clinically integrated entities. In the 1990s, the U.S. Department of Justice provided landmark opinions on the antitrust standards of clinical integration. Today, this core principle remains: if the network of providers creates a high degree of interdependence with a devoted interest in controlling costs and ensuring quality, the arrangement can meet federal agency antitrust scrutiny.

In 2012, under the Affordable Care Act (ACA), CMS released the first applications for the Medicare Shared Savings Program (MSSP), providing a framework for clinical integration. The program’s emphasis on impacting quality and cost goals for a patient population assigned to an ACO became a dominant example of the abilities of previously unavailable claims data.

This first MSSP iteration showed a steep learning curve to use data effectively and to build successful interventions across the national market. Other contracts paced the transition more appropriately for clinically integrated entities. Value-based contracts that focused on paying for successes by measuring and improving quality dominated the early adoption.

The Health Care Payment and Learning Action Network (HCP-LAN)—a group of public, private, and non-profit organizations devoted to spreading value-based care initiatives—built a framework and defined APMs on a continuum; Figure 1 shows these definitions from category one (fee for service) to category four (population-based payment). In building the APM framework, HCP-LAN authors agreed that the objective of payment reform was to change national trends and move payments into categories three (APMs built on fee-for-service architecture) and four (population-based payment), per Figure 1.

As transformation under the MSSP stressed measuring and managing the quality across newly integrated networks, ingesting data for quality reporting took substantial organizational effort. Important core data operations (e.g., financial metrics) were sidelined. Initially, two dominating competencies emerged among clinically integrated entities:

However, without a true sense of urgency to take on risk (due to minimal, publicly validated cost-reduction interventions), the general mandate for the first clinically integrated entities became clear: to understand how to measure and manage quality across a newly organized group of providers. Under this mandate, clinically integrated entities prioritized quality reporting objectives over other key considerations, including data ingestion, data activation, and cost reduction interventions.

To succeed in at-risk contracts, however, organizations must not overlook any competency. They must instead constantly review and optimize the five core PHM competencies through a continual review and improvement process.

To achieve PHM transformation, organizations must create a governance structure that uses an effective framework based on five competencies:

Figure 2 shows Health Catalyst’s framework for PHM success, from data and analytic transformation to payment and care transformation. A preliminary step to this framework is identifying organizationwide governance that will oversee the transformation to value-based care. A governance process that educates, engages, and energizes clinicians and stakeholders is a critical step in building a strong culture that supports difficult financial, clinical, and patient-focused decisions over the long-term.

As organizations establish governance, they typically form committees with charters that include authority and responsibility, definitions of success, and participation standards. This is a critical step, as many operational teams will work together for the first time, and/or in new roles, in value-based care transformation—often to impact metrics that are new to them.

A fast track to success in this step is bringing the right people into the operational teams. In general, clinically integrated organizations seek lean teams that can impact interventions. Several roles are critical for engaging executives and spreading quality and cost reduction initiatives:

As the governance structure evolves, organizations must take a data-driven approach to answer clinical, financial, and operational questions. To gather insights over time, health systems must identify a variety of sources that can produce intelligence and drive interventions across the clinically integrated entity’s needs. These interventions should not wholly depend on claims data.

For example, organizations often use cost movement (achieving lower total cost of care across a population by shifting the costs to a less-intensive resource) as an initial intervention based on available data. To reduce costs, claims data needs to be integrated with additional sources. Today’s clinically integrated organizations have begun using additional data sources to identify interventions that impact the actual costs necessary to deliver care to their patients.

Organizations drive intelligence by ingesting the following data:

To truly measure the cost of a healthcare encounter, organizations need all three of the above data sources. Next-generation costing products, such as the Health Catalyst® CORUS®, facilitate this understanding by helping organizations more comprehensively define the true cost of the services they provide and those services’ impacts on patient outcomes. Ingesting all of these data sources into a single source (such as a data operating system) creates an infrastructure that provides the most value upfront and long-term.

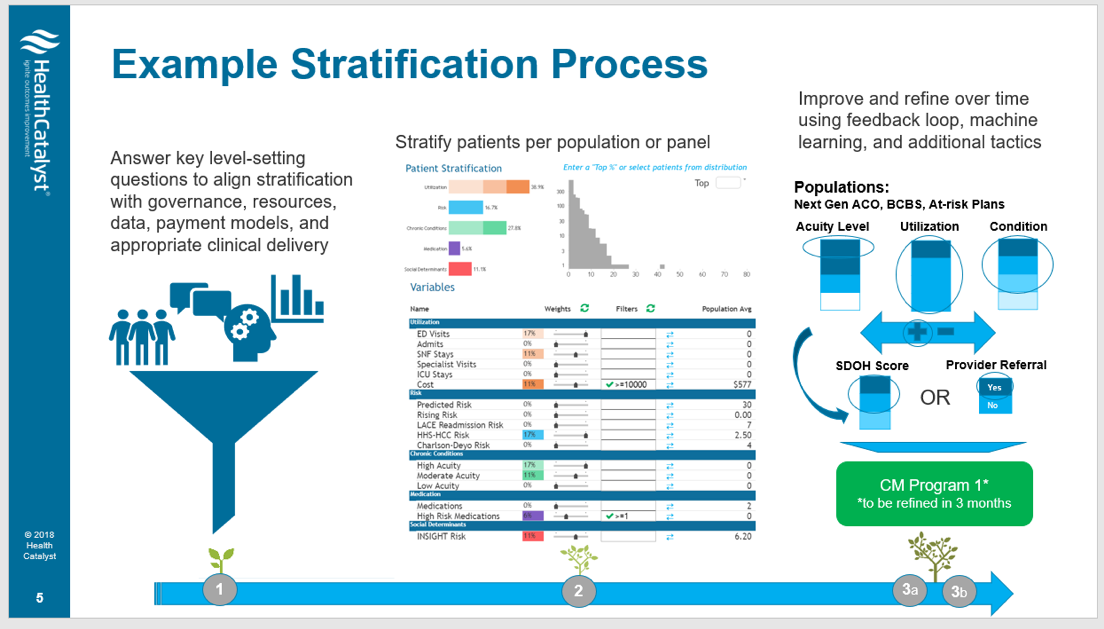

With the right governance structure and analytic backbone, clinically integrated entities are ready to identify appropriate contracts, patient populations, and interventions. During this stage, various teams (as defined under the governance structure) will answer critical questions to drive interventions to the appropriate patients. By incorporating disparate data sources into a common structure, clinically integrated entities are building intelligence that allows them to succeed in appropriate financial and clinical transformation initiatives.

Figure 3 shows how an operational vehicle (e.g., a clinical quality committee) can aggregate information and use an analytic tool to identify a population for a specific care management intervention.

Entering at-risk contracts (and not upside-only agreements) is necessary to achieve the appropriate financial revenues to sustain long-term value-based contracts. Organizations must seek a mix of contracts that appropriately align clinicians’ ability to impact select populations while meeting contractual obligations.

Some value-based contracts focus on leveraging an attributed patient population to reduce the total cost of care. The MSSP assigns attribution based on a combination of evaluation and management codes, which can unintentionally attribute patients to specialists or non-strategic entities (e.g., a neighboring physician whose tax identification number did not join the ACO).

Value-based contracts for specialists are increasingly available. Through a clinically integrated network, hospitals can structure quality and efficiency improvement programs that pay fair-market value for quality-based cost reduction initiatives. Bundled payments are emerging as a valuable source of distribution payments for specialists. For example, the top 25 performing participants in the first year of the Comprehensive Joint Replacement initiative anticipate receiving over $1,000 per episode after final program reconciliation is complete. By adopting such initiatives, broader, clinically integrated entities can mitigate the potential for specialist disenfranchisement under value-based care.

Care transformation is a key intervention for internal cost savings in value-based contracts. While streamlining an approach to systemwide quality remains an important component of clinical integration, it can be a high-cost, high-effort undertaking. By optimizing care management programs, care transformation helps organizations reduce clinical variation and improve cost savings across the network.

Partners Healthcare, a large, integrated healthcare delivery system, created its Integrated Care Management Program (iCMP) initially as a Medicare-specific intervention. Partners validated its model by examining Medicare patient data from 2012 to 2014, and reviewed overall total per beneficiary per month cost among other key metrics. The overall Medicare spending of patients enrolled in the Partners iCMP dropped by $101 PMPM (or $87 more than the cost decline for patients inside Partners’ ACO program), according to a 2017 study.

Clinical variation reduction initiatives have also proven to be effective cost-reduction methods. For example, when a large integrated delivery system aimed to reduce unwanted clinical variation, it deployed an analytics platform to aggregate and analyze patient outcomes data. As a result, the organization reduced cost per patient by $2,401 and length of stay by more than eight days. These achievements translated to projected millions in savings in subsequent years.

Generally, intervention design occurs alongside payment and care transformation. Depending on the data, clinically integrated entities identify the right value-based contract that meets their care transformation goals where they are and that they can impact with appropriate interventions.

The next step is to determine which intervention to implement first. To do so, organizations must answer key questions about how various initiatives may impact specific value-based contracts:

Organizations then must decide which type of intervention to bring to market and when. This step requires a review of important characteristics making up contracts, with many of those characteristics remaining consistent across payer entities:

Organizations need to identify the intervention’s expected time to value, the financial impact, which patient populations it applies to, and how will to operationalize it. Next, health systems will place these interventions into an operational plan to address their ability for scale across multiple value-based contracts. This can help identify the appropriate time to move into a risk-threshold that optimally straddles both fee-for-value and fee-for-service payments.

The journey to value-base care is ongoing yet delivers increasingly better-quality care to patients at a lower cost along the way. Organizations can structure their journeys to value-based care by continually evaluating their performance in relation to their value-based care competencies.

By understanding their current progress toward value-based contracting and factoring in local market needs, health systems can begin to identify strengths, as well as gaps, for effectively managing upcoming value-based care initiatives. Using a competency-based approach, and by leveraging purposeful interventions, organizations can create a framework for sustainable value-based contracting success.

Would you like to learn more about this topic? Here are some articles we suggest: